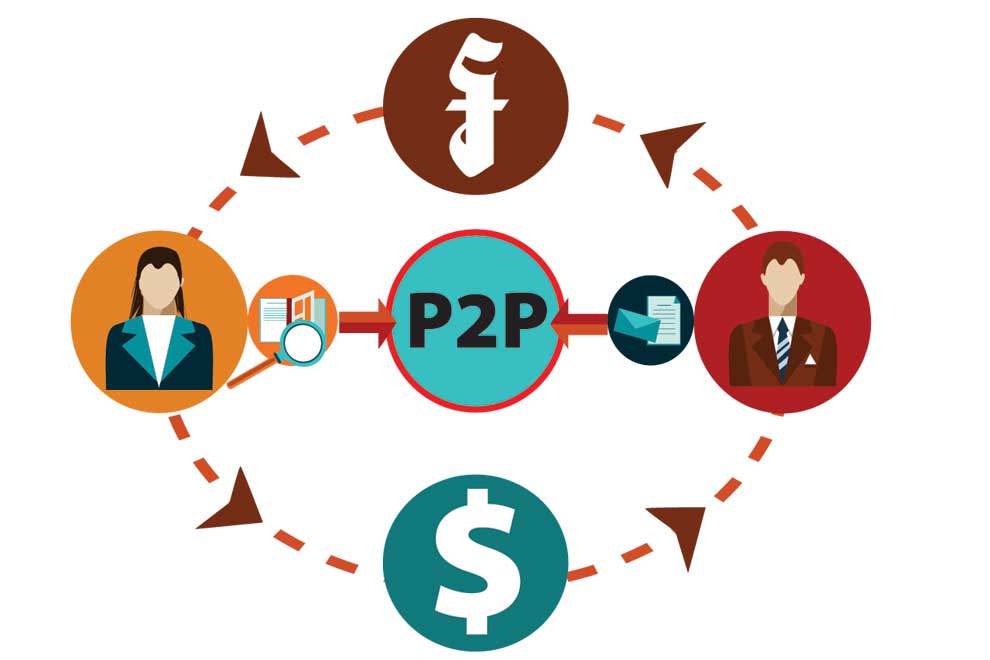

The P2P lending platform brings a lender and borrower together. GRAPHICS: POST STAFF

The peer-to-peer (P2P) lending model could possibly transform micro-financing and add to Cambodia’s digital financial ecosystem, which is fast gaining momentum.

The digital market place for loans could be the next wave in the financial technology or fintech sector, which can provide an alternative finance market for the underbank or the unbanked segment in the

Kingdom.

With only 20 percent of Cambodia’s 16 million people with bank accounts, the domestic market could be a fertile ground for P2P lending platforms which could facilitate borrowings at a lower cost and less paper work.

“With 98.4 per cent of the population in Cambodia without credit cards, there is a huge potential for the P2P lending industry to come into the market providing people, access to credit,” Cambodian Fintech Association vice president Eddie Lee told The Post.

“P2P lending is essentially lending. Just that in this current times, we have technology as the catalyst, making the loan application, due diligence, disbursement and collection more convenient and more effective.

“Peer to Peer lending is mostly used for short term financing between three to six months and usually not more than 12 months. Small businesses and farmers in the rural and urban areas could use the facility to bridge their financing,” he added.

Under the P2P model, an individual could apply for a low-interest loan from another person and the lender can make some profit instead of depositing his money in a saving account.

This model simply bypasses the traditional banking style where a borrower has to undergo vigorous evaluation process to source for funds and pay exorbitant bank interest rates .

According to the 2nd Asia Pacific Region Alternative Finance Industry Report , about $4.5 million were raised in Cambodia in 2016 through the P2P platforms.

The Accenture 2015 report said that investments in fintech across Asia-Pacific rose from $880 million in 2014 to $3.5 billion in the first nine months of 2015!

Lee: There is a huge potential for the P2P lending industry.

“That’s a lot of money invested in this space and presents a lot of opportunities to entrepreneurs,” said the report.

Digital banking and payment systems have taken off in a big way in the Kingdom and more tech-savvy Cambodians are moving into the digital financial space from paying bills to money transfers, and companies like Wing (Cambodia) Limited has added a new dimension to the mobile banking system in the country.

Backed by solid economic growth of about seven per cent annually, friendly investor policy and mushrooming of small medium entreprises (SMEs) – could possibly attract P2P players.

“For the country to transform into a digital (economy), we will also require market adoption, talents and investments to make it work. It will not be overnight."

“But the good news is, the technology is here as the catalyst and Cambodia is well poised for growth. I believe we will see a textbook version of the country with its young population, leap frogging into success and digital financial transformation,” added Lee.

The P2P industry should focus at serving the under-served SMEs and the unbanked due to the nature of the short term financing model, he added.

Will the entry of P2P players pose a threat to commercial banks? No says Lee.

“Should P2P blooms in a big way, it will mean that borrowers would have established a reliable credit score and will be eligible for better interest rates compared with traditional lenders. We have seen many borrowers who graduatedfrom P2P lending and became bankable."

“When that happens the banks will be able to onboard and provide credit facility to the borrowers who have proven track records. P2P lenders and the banks should also work together where their combined efforts will bring a better experience and greater outreach extending it to unbanked and the underserved,” he said.