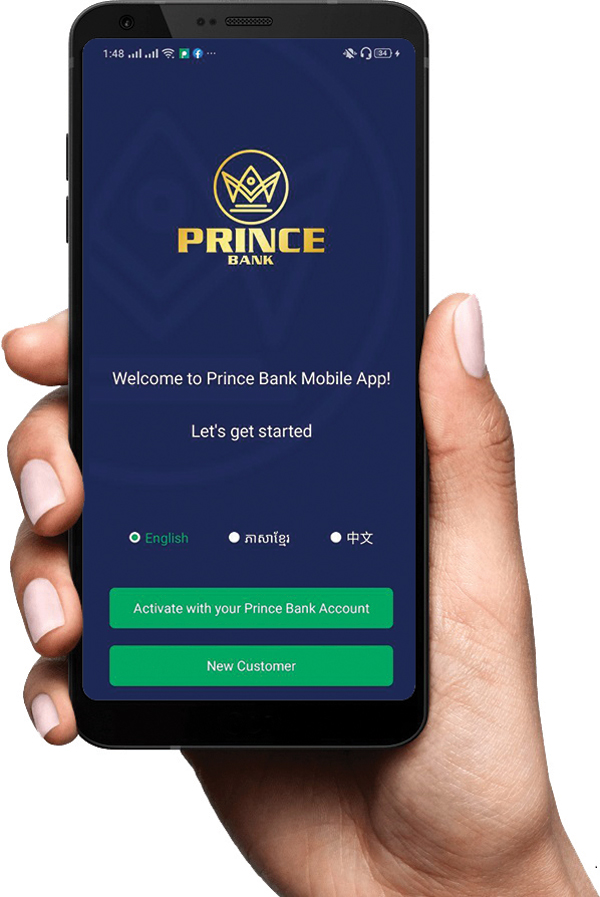

Prince Bank has embarked on an ambitious digital transformation drive with the goal of becoming the best digital bank in Cambodia. Photo supplied

Prince Bank Plc has launched a new enhanced mobile app to ensure its customers continue to enjoy the best digital banking experience, while remaining competitive in Cambodia’s dynamic banking sector.

The bank’s latest product, which was launched last Thursday, is another crucial step in achieving its digitalisation ambitions.

“Most banks in Cambodia provide normal mobile banking features such as transfers from one account to another and checking your account balance [among others].

“Only a few banks are very aggressive in developing their mobile banking, and Prince Bank is one of these. Using our Prince Bank App, you can perform many banking transactions anywhere at any time,” the bank said in a press statement.

The latest app comes with multiple features – such as creating new savings and current accounts, conducting priority banking at your convenience and opening new term deposits conveniently, all with the options you prefer.

You can also pay bills anywhere and at any time, such as mobile and internet top-ups, as well as for TV and entertainment subscriptions, public services and insurance payments.

Users can also view their debit card transactions conveniently on their mobile device with the app, as well as easily apply for debit and credit cards.

There is also the flexibility of being able to temporarily block or unblock your cards and change your PIN. You can also apply for a new cheque book from anywhere, and choose any Prince Bank branch to pick it up from.

Using the app, the bank’s clients can avail themselves of the “Bakong Wallet” – a quick transfer of funds to any other “Bakong Wallet” – and enjoy cashless payments through scanning to pay directly at participating merchant.

Prince Bank plans to target business owners – especially of small and medium enterprises – and professionals in the Kingdom with the newly enhanced mobile app, which will ease banking for those on the go.

The app comes a week after Prince Bank launched its credit and debit cards, part of vigorous moves to promote its digital banking in Cambodia.

The mobile app will be useful for busy professionals. Photo supplied

“First of all, one of our shareholders’ and business goals is that we want to be the best digital bank in Cambodia in the next three to five years.

“Currently, we can say that we are the fastest growing digital bank in Cambodia – and we are aiming to become the best digital bank in the Kingdom in the near future.

“We have been investing heavily in our digital banking and in technology since 2018. We are continuing to improve in this key area to achieve our goals,” said the statement.

Prince Bank started its operations in the Kingdom in 2015 as a private microfinance institution, but three years later it transformed into a commercial bank.

“Being a digital bank transcends beyond just banking apps and technology.

“It is all about our mindset and how we approach our business, customers and ourselves to bring forth speed, simplification and staying lean to solve users’ pain points and deliver a ‘wow’ experience,” said Jennifer Lee Cheau Lin, chief digital and technology officer at Prince Bank.

For more information, contact: 1 800 20 8888.